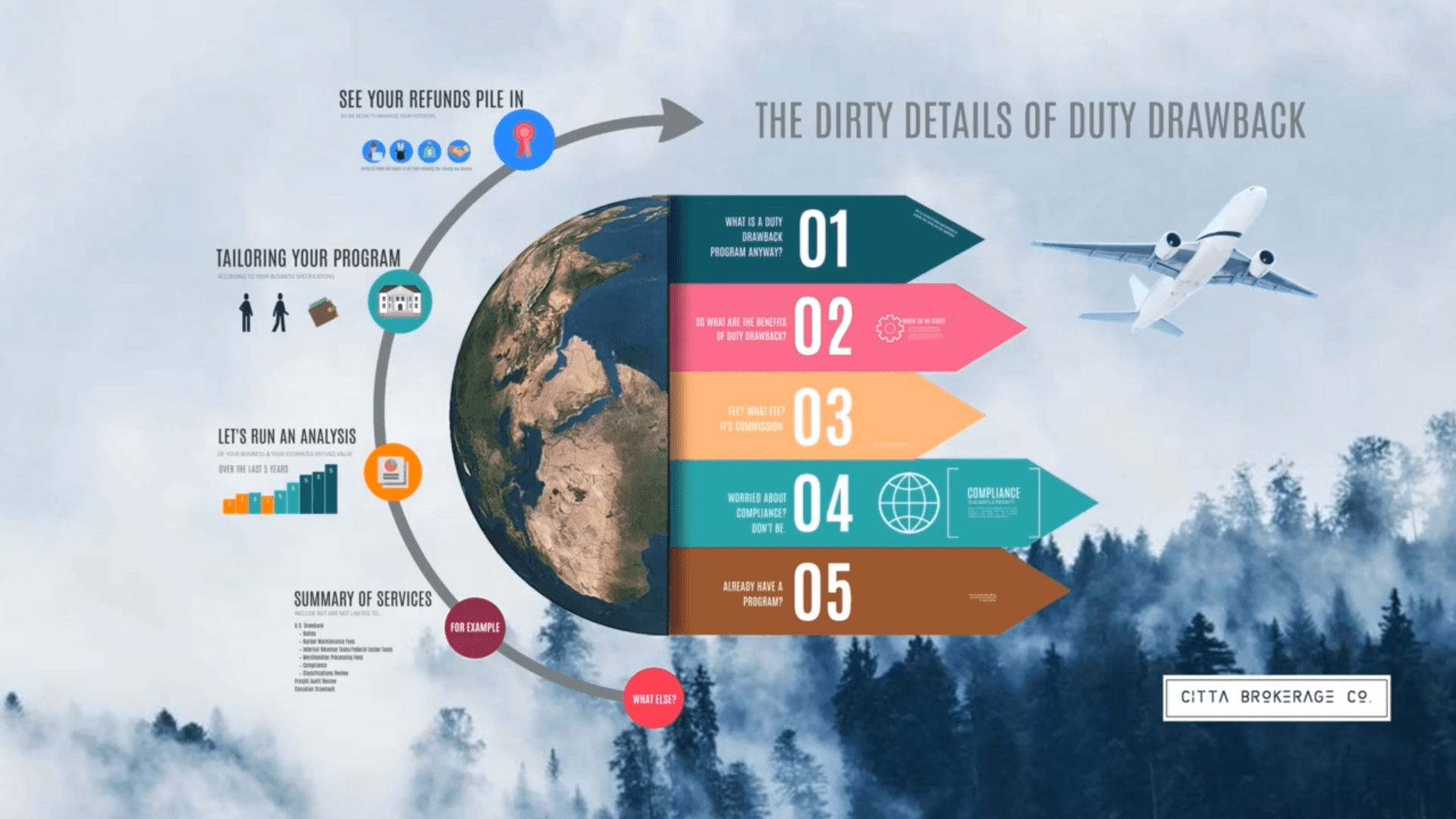

As import tariffs increase and evolve, NOW is the time to establish or strengthen your duty drawback program.

To ensure you recover every dollar US Customs and Border Protection owes your organization, you need a partner. With 40 years of experience in duty drawback, our experts:

- Simplify the process

- Ensure compliance even when regulations change

- Maximize your returns

And, we can help you recoup duties paid over the last 5 years.

Let’s get started.